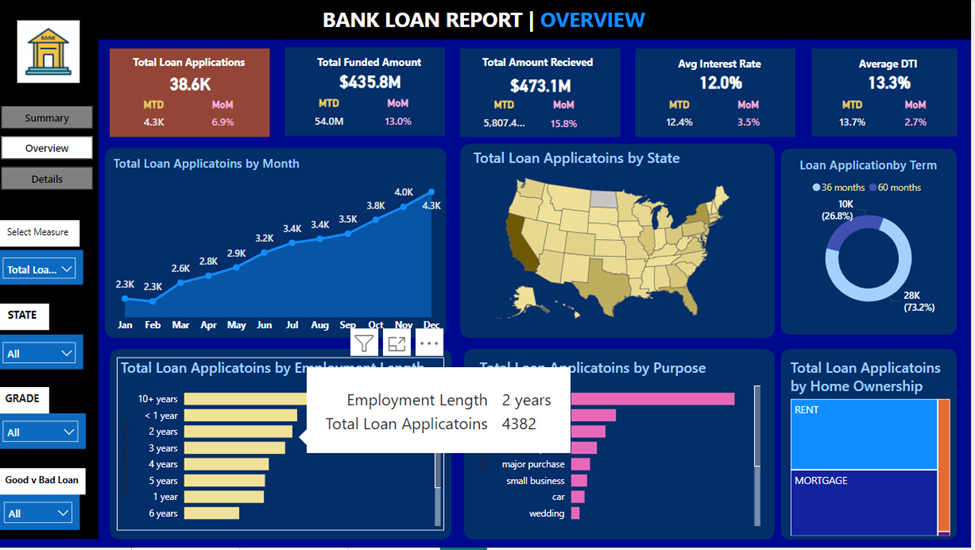

Key Performance Indicators (KPIs) Requirements:

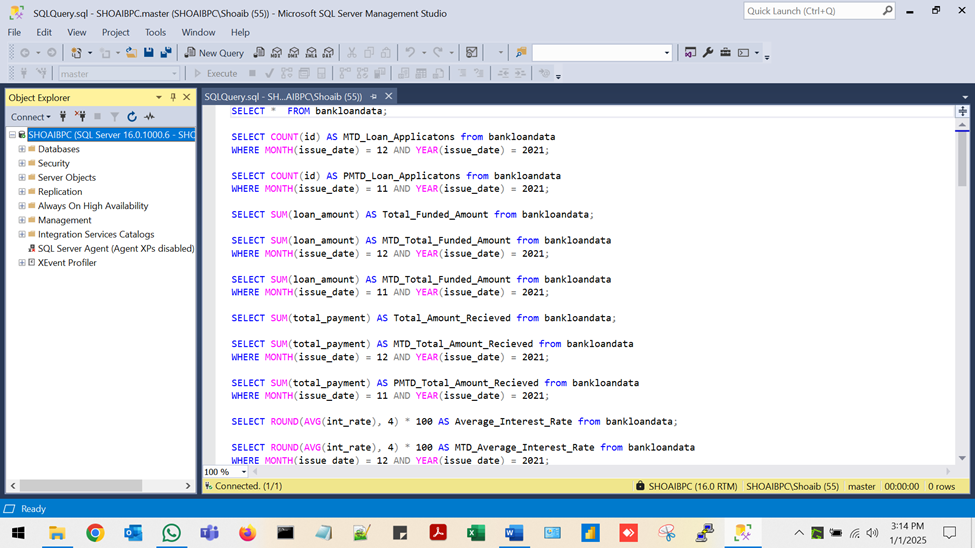

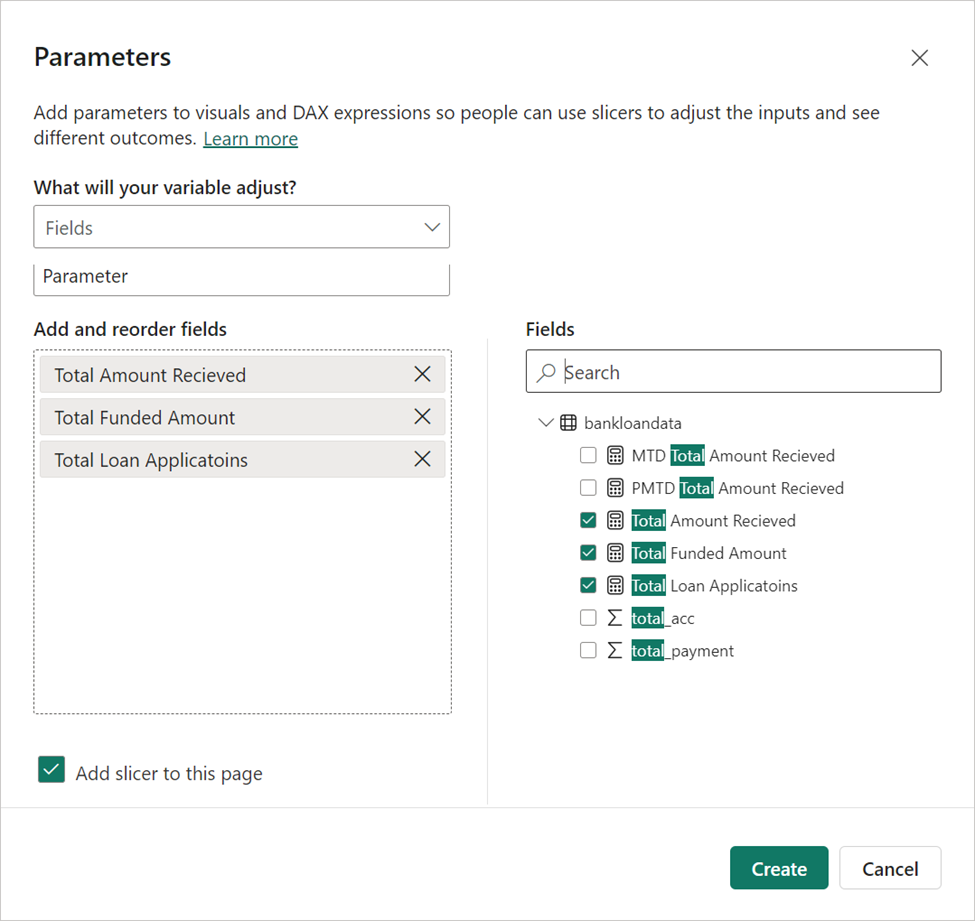

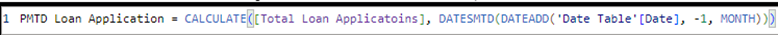

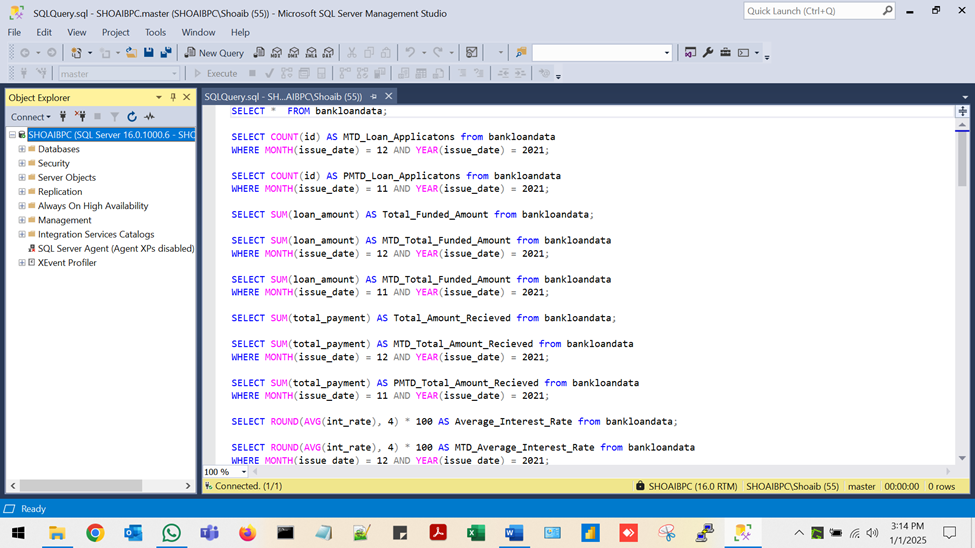

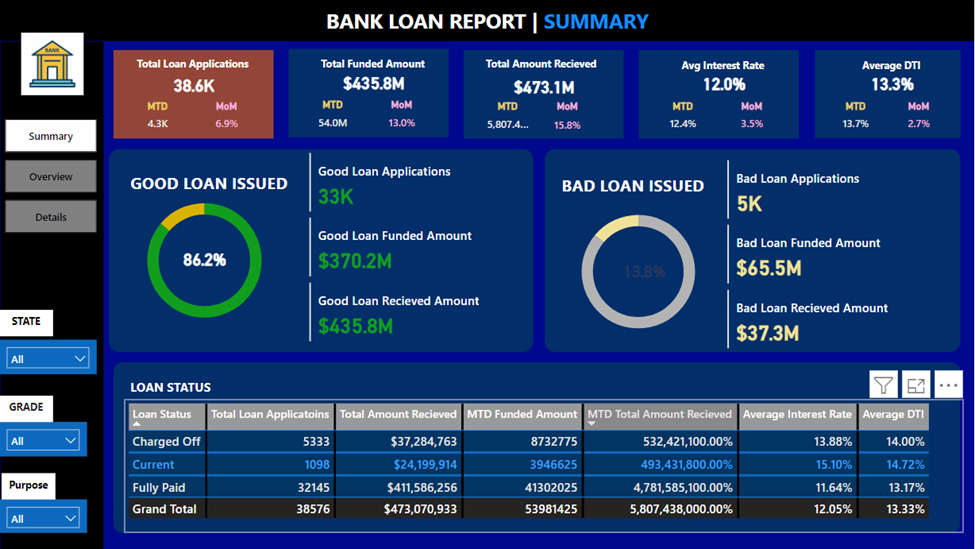

- Total Loan Applications: We need to calculate the total number of loan applications received during a specified period. Additionally, it is essential to monitor the Month-to-Date (MTD) Loan Applications and track changes Month-over-Month (MoM).

- Total Funded Amount: Understanding the total amount of funds disbursed as loans is crucial. We also want to keep an eye on the MTD Total Funded Amount and analyse the Month-over-Month (MoM) changes in this metric.

- Total Amount Received: Tracking the total amount received from borrowers is essential for assessing the bank’s cash flow and loan repayment. We should analyse the Month-to-Date (MTD) Total Amount Received and observe the Month-over-Month (MoM) changes.

- Average Interest Rate: Calculating the average interest rate across all loans, MTD, and monitoring the Month-over-Month (MoM) variations in interest rates will provide insights into our lending portfolio’s overall cost.

- Average Debt-to-Income Ratio (DTI): Evaluating the average DTI for our borrowers helps us gauge their financial health. We need to compute the average DTI for all loans, MTD, and track Month-over-Month (MoM) fluctuations.